Most foreigners come to Malaysia to kick back, relax and enjoy their golden years. But if you’re here to be part of the workforce, it would be a good idea to familiarize yourself with Malaysia’s Employees Provident Fund, or EPF, as a means to build your retirement nest egg.

What is EPF?

EPF refers to a social security institution under the Ministry of Finance Malaysia, which manages a compulsory savings and retirement planning scheme for legally employed workers in Malaysia. It is considered a vital component in Malaysia’s multi-pillar pension framework.

EPF’s primary function is to help employees from private and non-pensionable public sectors save a fraction of their wages – to be used when the employees retire or are no longer fit to work. Additionally, EPF provides a framework where employers are obliged to contribute towards their employees’ savings, hence meeting their statutory and moral obligations to their workforce.

At current, it is mandatory for employed Malaysian citizens to contribute to the EPF. Foreigners working in Malaysia are not obligated to contribute to EPF but may opt to do so.

How Does EPF Work?

Basically, EPF manages a “forced” savings scheme, which deducts a portion of an employed individual’s monthly wages and places that money into an account for retirement purposes.

In Malaysia, employed Malaysian citizens up to the age of 60 are obligated to contribute 11 percent of their wages into their respective EPF accounts each month. Correspondingly, the employers contribute an additional amount equivalent to 12 percent of the employees’ monthly wages. For employees earning RM5,000 or less a month, employers’ contribution rate is increased to 13 percent.

Example:

For an employed Malaysian below the age of 55 who earns RM10,000 a month:

– The employee contributes = 11% X RM10,000 = RM1,100 per month

– The employer contributes = 12% X RM10,000 = RM1,200 per month

– Total monthly contribution = RM2,300

NOTE: the above rates apply for Malaysian citizens only. Read on to find out more about EPF policies affecting foreigners working in Malaysia.

The monthly contributions, once received, are invested by EPF into a number of approved financial instruments, which include, amongst others, Malaysian Government Securities, Money Market Instruments, Loans, Bonds, Equity and Properties, to generate income. The income is distributed back to the EPF members’ accounts in the form of dividends each year.

When an employed individual reaches 60, he may opt to continue contributing to EPF at a reduced rate of 5.5 percent of his wages, should he remain in the workforce. For such an employee, the employer’s contribution rate is reduced to 6 percent or 6.5 percent (if the employee earns RM5,000 or less a month).

The Many Benefits of EPF

If you plan to be employed in Malaysia, EPF is a great retirement-planning device for a number of reasons.

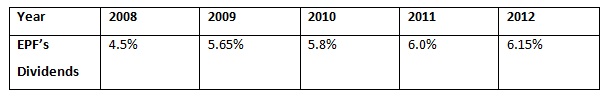

For a start, EPF has a guaranteed minimum dividend rate of 2.5% p.a., and historically generates higher returns compared to fixed deposits and savings accounts in Malaysia. At the moment, many banks in Malaysia are offering approximately 3% p.a. interest for their conventional fixed deposit accounts. By comparison, EPF’s dividends of 4.5 – 6.15% over the past five years are significantly more attractive:

Secondly, EPF is a great way to get someone other than yourself – namely, your employer – to contribute to your retirement. Based on a typical employer’s contribution rate of 12%, an employee would be generating an additional RM1,200 savings per RM10,000 wages every month using EPF, which equates to a staggering RM14,400 each year!

An added benefit of EPF contribution is that it qualifies for tax deduction by way of personal relief. Dividends generated from EPF are also exempted from tax.

EPF Application Procedure & Contribution Rates for Foreigners Working in Malaysia

As previously mentioned, EPF contribution is not mandatory for foreigners working in Malaysia; but you could opt to do so by submitting a notice of election to contribute using Form KWSP 16B and then registering as an EPF member using Form KWSP 3. This can be done at an EPF office / counter though an easier alternative would be to get a local employer to undertake the procedure.

When you elect to contribute to EPF as a foreigner, you are obligated to contribute 11 percent of your monthly remuneration to your EPF account. But unlike the employer contribution benefits enjoyed by Malaysian citizens, an employer in Malaysia is only obliged to contribute a minimum of RM5.00 per month to a foreigner’s EPF account regardless of how much he earns.

Nonetheless, thanks to an EPF policy that allows both employer and employee to contribute more than the statutory rates; it is not unusual for Malaysian employers to include a far more respectable EPF contribution as part of your remuneration package, especially for highly sought-after professions. If you plan to contribute to EPF, it is in your best interest to request for better employer contribution to your EPF account during the negotiation process with your prospective employer.

Maintaining Your EPF Number

When you successfully register yourself as an EPF member, you will be issued an EPF membership number. This number also acts as your account number, which will be used for all your transactions with the EPF, including contribution payments and withdrawals. Take note that each EPF member will only receive one EPF membership number regardless of the number of jobs you hold.

In the event that you change jobs during your tenure in Malaysia, you will need to inform your new employer of your EPF membership number for the purpose of EPF contribution.

Withdrawal from Your EPF Account

Under the EPF framework, a member’s contribution is divided into two accounts: Account 1, which includes 70 percent of the total amount contributed to EPF; and Account 2, which comprises 30 percent of the total amount contributed to EPF.

Example:

If you have RM100,000 in EPF savings:

– Your Account 1 holds = 70% X RM100,000 = RM70,000

– Your Account 2 holds = 30% X RM100,000 = RM30,000

Based on existing policies, Malaysian citizens are allowed to make withdrawal from Account 2 at the age of 50; as well as full withdrawal from both Accounts 1 and 2 upon hitting age 55*, immigrating to another country, or being confirmed as disabled or deceased. They are also allowed to make withdrawal from Account 2 for other purposes such as buying a home, financing the cost of higher education or paying for medical treatment of critical illnesses, just to name a few.

*NOTE: In 1 July 2013, Malaysia has officially changed its minimum retirement age from 55 to 60. This may eventually affect the age to which EPF members are allowed to withdraw from their EPF savings. At the moment, the age for full withdrawal remains at 55 for Malaysian citizens.

Unfortunately, withdrawal of EPF contribution for foreigners is far less flexible. At current, EPF withdrawal for a non-Malaysian is permissible only when the individual ceases to be employed in Malaysia and leaves Malaysia on a permanent basis, or upon confirmation of death. To put it simply, your EPF contribution is effectively “locked” until your employment is concluded and you choose to leave the country.

Take note, however, that there are certain exceptions. If you are a non-Malaysian who had become an EPF member before 1 August 1998 or had obtained a Permanent Resident status, you will be able to make withdrawal and pre-withdrawal just as all other Malaysian citizens could.

EPF – Should You or Shouldn’t You?

For anyone who’s been assigned to a foreign country to work, choosing to or not to participate in the local social security or pension scheme is always a tricky question… and EPF is no exception.

As a retirement-planning vehicle, EPF is an excellent platform for salaried workers to build a retirement nest egg – thanks to the high returns, the reliability and the tax breaks. But on the other hand, the current limitation in EPF withdrawal by a foreigner means that barring any drastic changes in policies, you would most probably only be able to access your EPF savings when you leave Malaysia permanently or become a Permanent Resident in Malaysia.

Ultimately, all foreigners working in Malaysia are advised to consider the implications before making a decision. To obtain more details about EPF, visit the official portal at www.kwsp.gov.my.

This article is brought to you by iMoney.my, the leading comparison site for financial products comparison. Check out their iMoney Home Loan Calculator tool here.

More Finances Tips in Malaysia:

- The Ultimate Guide for Tax Deductions in Malaysia

- How to Apply for Credit Cards in Malaysia

- A Review of Malaysia’s Bank Notes

- 3 Services for Transferring Money To and From Malaysia

More Insights about Visas in Malaysia:

- Obtaining Permanent Residency in Malaysia: What You Should Know

- Work Permit Visas in Malaysia

- Malaysia My Second Home (MM2H) Visas

"ExpatGo welcomes and encourages comments, input, and divergent opinions. However, we kindly request that you use suitable language in your comments, and refrain from any sort of personal attack, hate speech, or disparaging rhetoric. Comments not in line with this are subject to removal from the site. "

There is a another obvious benifit of RM 5000 tax exemption yearly if you contribute to KWSP